Debit VS. Credit

If you weren’t trained in accounting, you’re probably not very familiar with some of the practices. Whether you’re here because you intend to do the accounting for your business, or you just want to broaden your understanding of some core concepts, we can help.

Debits and credits are a fundamental part of accounting. Though the concept is simple (debits-in, credits-out), the execution can be tricky at times since there are exceptions to the rule. That being said, it’s important to get a handle on them since your books need to balance.

At GEPC, we can help you understand their role in your business. It’s time to take charge of your finances.

what are they?

Accountants use debits and credits to keep track of the flow of money going in and out of accounts. Debits are always on the left and credits on the right.

Debits are typically used to represent money going into an account, while credits represent money coming out of an account.

For example, if Company A purchased a piece of equipment, their assets would increase by the purchase amount and their cash account would decrease by the same amount. If the amount were $500, it would be recorded as follows:

Some accounts are slightly more complex; when it comes to equity, revenue, and liability accounts, increases to the account are recorded as credits.

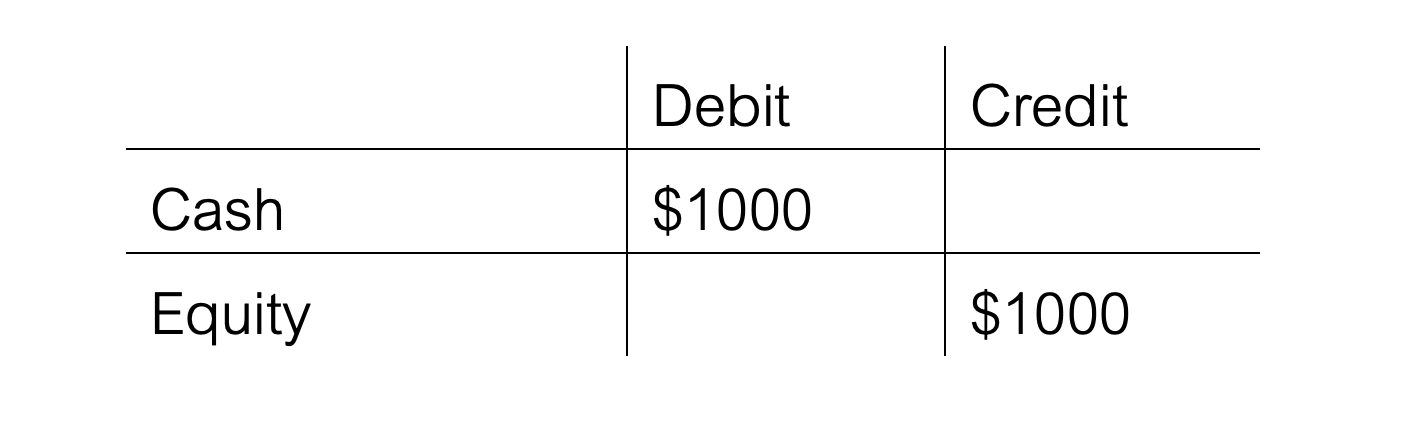

If someone purchases equity in Company A then their cash account would increase (be debited) by the amount of the investment, and their equity account would be credited by that same amount. This is because equity is considered money ‘taken out’ against the company. If the amount were $1000, it would be recorded as follows:

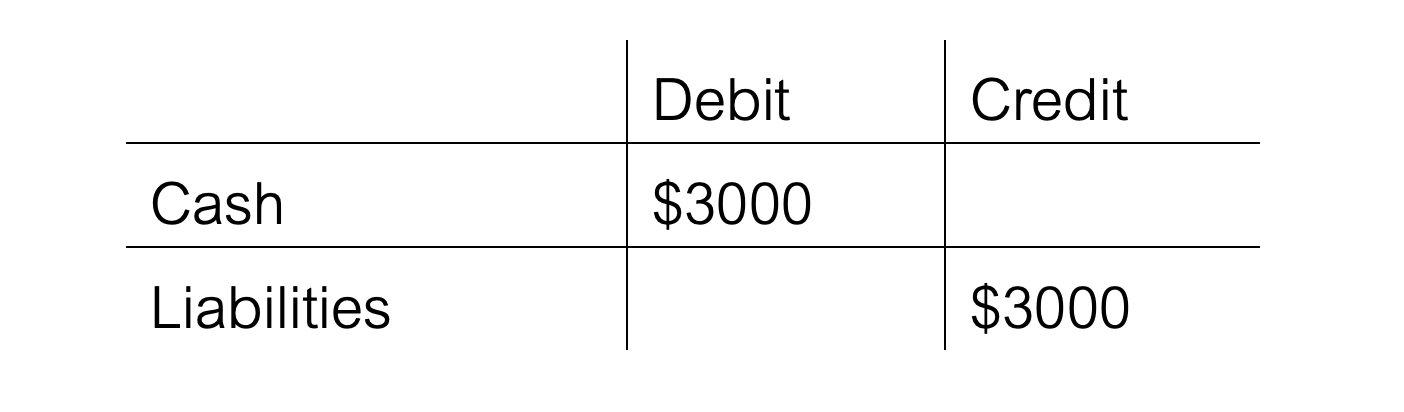

If Company A takes out a bank loan, their cash account would increase by that amount, and their liability account would also increase. However, increases to liability accounts are credited since they represent the amount of money that the business owes in the future. If the loan amount was $3000, it would be recorded as follows:

If Company A earns revenues, their cash or accounts receivable accounts would increase and the revenue account (though also increasing) would be credited. If the revenue was $2000, it would be recorded as follows:

How do they impact your business?

Debits and Credits will need to be recorded accurately so they balance out at the end. If it does not balance, that means that something was recorded incorrectly.

Want More Information?

Schedule a free consultation at gregevans.ca or (705) 880-2224 to learn more about what we have to offer. It all starts with a conversation.